We offer customised advice with access to full investment universe and asset classes.

We offer customised advice with access to full investment universe and asset classes.

- Investment portfolios are customised to your specific requirements, risk-return objectives and unique investment constraints. Various risk profiles and specific investment strategies are also available.

- Asset allocation is a key driver of investment returns in the long term.

- Our approach is based on active and international investment management, risk management and a transparent portfolio service.

- Our independence enables us to offer full access to a large number of financial institutions and their products and services.

Investæ Finances provides three core services :

- Investment advisory

Clients benefit from customised portfolio management advice and recommendations from international experts while retaining full responsibility for the investment decisions. Advice is based on your specific objectives and investment strategy.

Our advice adjusts to the type of your investment accounts, life insurance policies, investment mandates.

- Dedicated investment funds

Dedicated funds are customised and managed on a discretionary basis in accordance with our clients’ investment strategy. They access the full investment universe : multi asset class, multi manager and multi currencies. Client assets are deposited in segregated accounts with authorised custodian banks. Investment managers and custodian banks may be changed at any time.

- Mandate supervision

We supervise our clients’ discretionary investment mandates, define the investment guidelines, select the investment management companies, monitor portfolios’ risks and performances on a consolidated basis. We follow a rigorous multi asset, multi manager methodology.

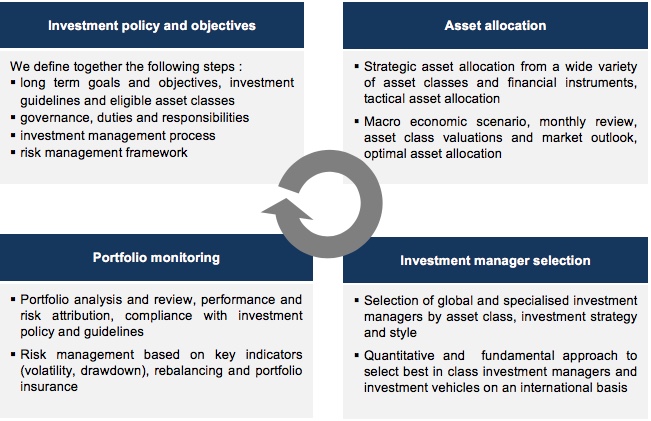

The major stages of our investment process are as follows :

ESG factors

Our current investment policy does not follow Environment, Social or Governance (ESG) factors. We are therefore not subject to principles for responsible investment. We reserve the right to change this policy in the future and would inform you in due course.

In selecting investment managers we do however include factors such as ethics, responsibility and accountability, quality and information transparency.